The crypto community has been longing for worldwide mass adoption of cryptocurrencies. With Venezuela seemingly on the verge of an economic collapse, could Bitcoin be the almighty saviour?

Let’s take a look at whether Bitcoin could save Venezuela from an economic collapse.

Financial instability

Venezuela is currently lacking financial stability. In fact, the country has been suffering badly from hyperinflation.

Hyperinflation is a form of monetary inflation, but it occurs at a much greater rate. Venezuela’s hyperinflation has risen so dramatically that the country is in dire need of a financial solution.

While Bitcoin isn’t exactly a firm alternative due to its volatility, it could become a hedge against the national currency.

Bitcoin could become a hedge because it is a decentralised digital asset that anybody can freely purchase and invest in.

This is one potential avenue for how Bitcoin could be used in Venezuela.

Venezuela is already exploring crypto solutions

Using cryptocurrency is not a new concept in Venezuela.

Back in 2018, Venezuela’s leader, President Maduro, released the Petro – a government-issued cryptocurrency.

The Petro is allegedly backed by Venezuelan oil, though there does not seem to be evidence to substantiate this.

Furthermore, the Petro is reportedly a means to circumvent US sanctions.

Without evidence to prove that the Petro is backed by Venezuelan oil, it is easy to see why people would be distrustful of the cryptocurrency.

Bitcoin has been around for some time and it can be viewed transparently on the blockchain, whereas currently, it does not seem as though the Petro can be viewed on a blockchain.

The white paper for the Petro outlined how it would be available for viewing on the Ethereum blockchain, but the last transaction made with Petro on an Ethereum blockchain was made 356 days ago at the time of writing.

After the Initial Coin Offering (ICO) for the Petro ended earlier than anticipated, the Petro website went live. On the website is a block explorer (to view the blockchain), but information cannot be obtained from it.

Considering transparency is a key aspect of cryptocurrencies, the Petro does not appear to be transparent at all.

With all of this in mind, it is easy to see why the Petro has not been a successful venture.

However, this isn’t to say it can’t be a viable solution in the future.

Venezuela Bitcoin trading

While the Petro does not appear to be a viable solution for Venezuela, Bitcoin could be.

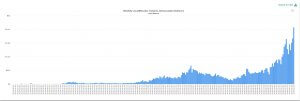

Recently, Coin Rivet reported on how Venezuela has seen Bitcoin trading volumes surge.

Without a doubt, it is already clear that Bitcoin trading is becoming an option for many residents in Venezuela.

While this chart only reveals data regarding the trading volume and not investment, with trading volume increasing as much as it has over recent months, it stands to reason that many Venezuelans have also invested in Bitcoin.

Furthermore, as the chart reveals, Venezuelans had begun trading with Bitcoin before the Petro was announced. This tells us that the citizens of Venezuela were already seeking financial alternatives.

Bitcoin won’t prevent an economic collapse, but…

To be brutally honest, Bitcoin alone cannot solve Venezuela’s issues.

The crypto markets are notoriously volatile, with prices subject to change at any given moment. The situation in Venezuela is real, torrid, and unfortunate.

To claim Bitcoin could be the country’s saviour would be too naive.

In this situation, there are two facts: Venezuela is suffering immensely from hyperinflation and Bitcoin is incredibly volatile.

To replace a failing economy with one that is not stable should not be considered a ‘real’ solution. It is a temporary buffer at best.

However, going back some months, a Venezuelan Reddit user posted how they had received 0.5 Nano.

While this is a tiny amount of money for somebody in the Western world, this small figure was enough to buy the user food and medicine. Not only was this enough for themselves, but also their family and neighbours.

This highlights how cryptocurrency could aid Venezuela.

While Bitcoin could provide some alleviation and relief to the situation in Venezuela, it isn’t going to magically fix it.

Venezuela does look to have a future in crypto, and one day crypto might become the norm there. But Bitcoin isn’t likely to solve their economic crisis anytime soon.

Interested in learning more about Venezuela and Bitcoin? You can discover more about Venezuelan gold or Airdrop Venezuela trying to raise $1 million to aid those in need on Coin Rivet.

Disclaimer: The views and opinions expressed by the author should not be considered as financial advice. We do not give advice on financial products.